A strategy and management consultancy

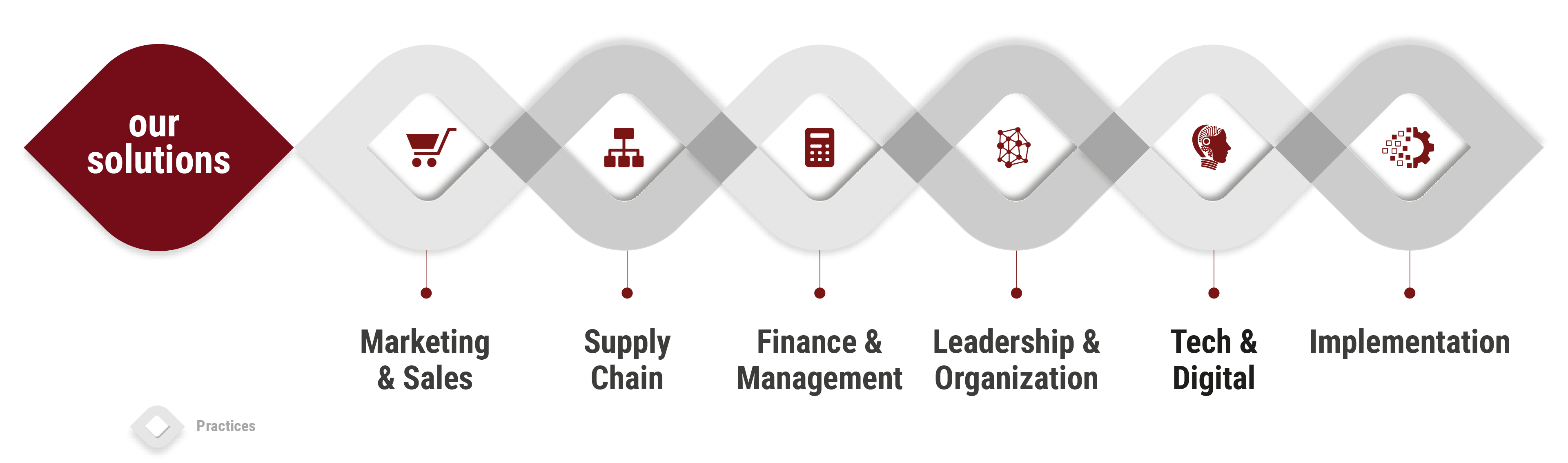

focused on implementable solutions

leveraging organizations, teams, and individuals

delivering a unique experience

A strategy and management consultancy

focused on implementable solutions

leveraging organizations, teams, and individuals

delivering a unique experience

WATCH WHAT OUR CLIENTS HAVE TO SAY

7 offices across 3 continents

Our track record across 55+ industries

APPLY NOW

THE CONSUMER LENS

KEEP THE ETHICS AND INTEGRITY