What challenge(s) do our clients face?

The persistent art and struggle facing startups and scale-ups rests on a dynamic balance between three core yet competing elements:

- Speed for expanding and getting viable products to market (first)

- Agility for adjusting to realities, needs and new business hypotheses

- Professionalization for greater stability and maturity to ensure perpetuity while becoming less prone to risks and turbulence

As a consultancy, we seek to understand the mindset of startups and scale-ups and to serve as an effective partner to help them accelerate down a path to success. We leverage/reinforce our innovative, flexible and customized solutions to address challenges – both internal and external – that emerging players frequently face when seeking to break into new spaces at home or abroad:

- How do we position ourselves strategically with a unique value proposition and ensure a good market valuation?

- Mapping user journeys and experiences

- Establishing strategic positioning by resolving key issues while adding value and efficiency

- Analyzing white spaces as well as major cost and efficiency levels

- Determining market sizes and potential while assessing the competition

- Knowing how to grow via a growth-hacking strategy to arrive at a major valuation thesis

- How do we balance growth and speed while professionalizing our corporate structure?

- Bringing products to market as quickly as possible

- Testing and learning to accelerate the process of reaching a winning minimum viable product (MVP)

- Managing the transition from a more casual to a more structured organization

- Researching consumers and clients to turn MVPs into winning solutions

- How do we improve current operations to promote cost efficiency and profitability?

- Calculating the distribution and the cost basis for entering a given market

- Tackling business/operational challenges and right-sizing the organizational structure

- Integrating data analytics for a better understanding of clients and results

- Optimizing logistic network and distribution optimization

- How do we leverage strategic M&As to expand?

- Successfully executing post-merger integration

- Defining growth avenues and strategic partnerships

- Formulating the right investment thesis

- Conducting commercial due diligence

- How do we effectively pursue expansion beyond our base?

- Navigating market, legal, consumer, geographic and context-specific dynamics

- Identifying and prioritizing the most suitable/lucrative markets for products/solutions

- Understanding the consumer journey and main pain points in the value chain

- Defining the right MVP to test and launch in the market

How do we help?

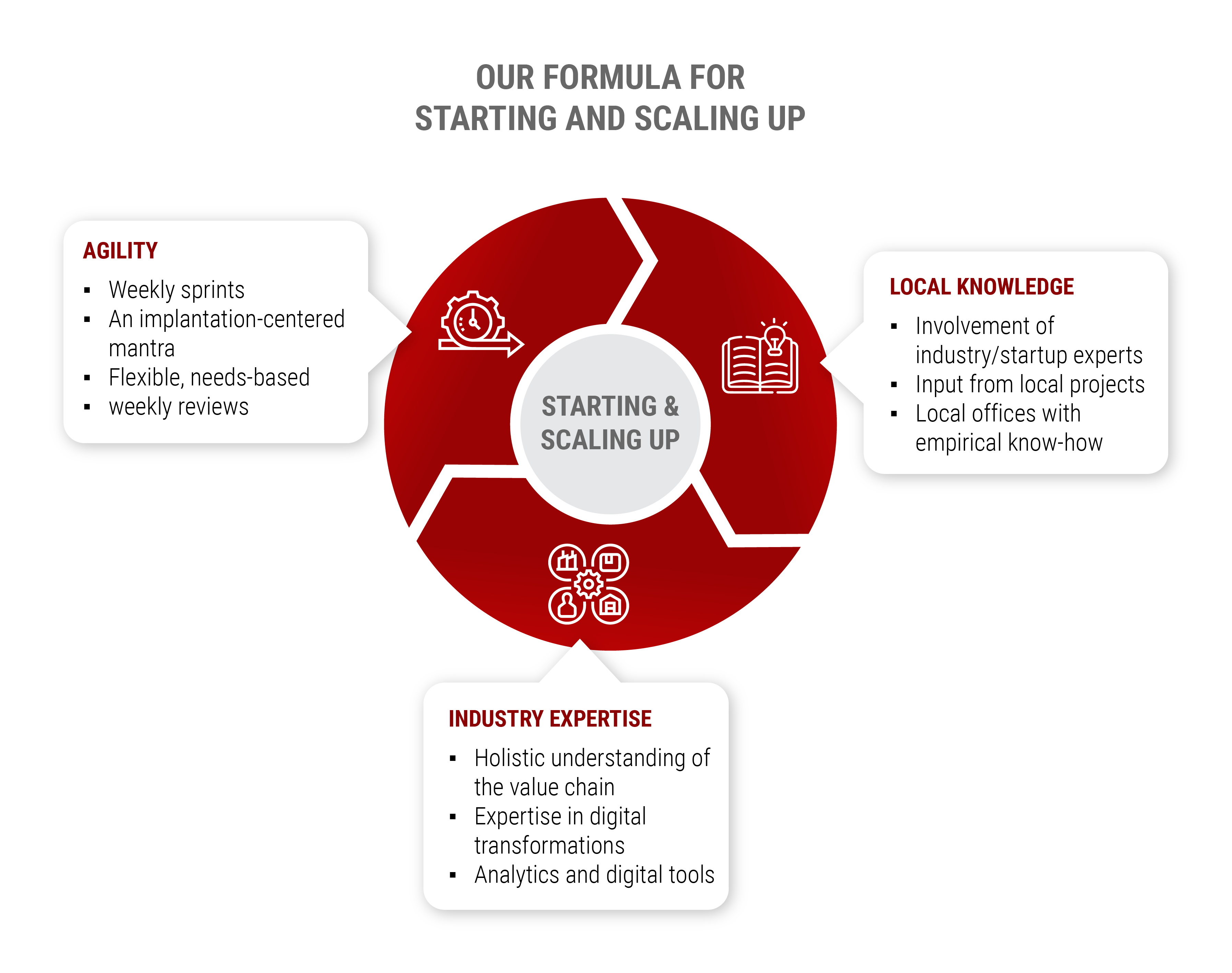

Drawing on experience guiding companies across the globe, our approach to consulting balances the need for startups and scale-ups to be quick, to test out and to learn. This approach is based on a blend of agility, deep local knowledge and industry expertise paired with a structured method for maturing and developing the business.

We understand that commonly applied solutions – from market entry strategies to post-merger integrations and governance design – are fundamentally different for startups and scale-ups. They demand high degrees of flexibility and unconventional ways of working based on collaborative tools, a mindset of “answer first, diagnose later”, pragmatism and a flat hierarchy.

During projects, concepts need to be nailed down and implemented quickly. This means details should be fine-tuned along the way while accepting the fact that making mistakes and learning from them is better than being slow. Moving beyond “conventional” approaches to consulting while continuing to draw on structured guidance and solid methods, we adapt to the needs of each startup and scale-up in terms of the speed and agility demanded of the environment, providing:

- Tailor-made approaches and adapted consulting methodologies calibrated to your unique context and culture – with agile, faster and more cost-effective ways of working

- Structures and ways of working that may need support in order to mature, allowing you to execute large-scale projects with a structured and holistic mindset

- A challenge to the status quo from an outside perspective, with implementable solutions offering the independence you need to move ahead on your own

- A focus on working with people behind the business, with flexible methodologies and tools to extract full potential from both individuals and teams inside the organization.

Commonly applied services

Clients

Integration’s track record in the Startups & Unicorns crosses geographies and clients is diverse. Some of our recent clients include:

Scale-ups

Startups

SUCCESS STORIES

INDUSTRY:

IT INFRASTRUCTURE

COMPANY’S AGE:

5 YEARS

CHALLENGE

Following a period of rapid expansion, this recently established business was in need of a suitable governance model to allow for continued growth in a controlled and strategic manner.

Rapid growth had led the organization to concentrate information and decision-making at the CEO and CFO level, with high involvement in day-to-day operational activities. One of the key challenges involved defining the correct degree of centralization between the company’s HQ and its international operations – considering their various stages of maturity and different structures.

APPROACH

Seeking to take a more flexible approach to applying our methodologies, we addressed the main pillars of a classic governance model: instances, rituals, KPIs, roles & responsibilities (R&R) and decision-making processes. An initial assessment was conducted to identify the main opportunities within each of these pillars, followed by discussion workshops to set out R&R during the design stage.

This meant delivering new R&R definitions for key areas within an RACI matrix, criteria to determine the new instances for each international operation, a new scheduling system and rituals to ensure flows of information, and a more robust decision-making process along with metrics to measure results for each area. Finally, an implementation schedule was designed considering different waves and prioritizing certain areas to target the most high-impact changes and benefits.

RESULT

The result of the project was an effective division of R&R across areas as well as across levels. The CEO and CFO agreed to assume a more hands-off approach yet obtain all the necessary information for decision-making based on the new set of rituals.

Additionally, the key area of engineering underwent internal restructuring to demarcate boundaries and responsibilities among managers, thereby avoiding overlapping decisions and reducing workloads.

INDUSTRY:

E-COMMERCE

COMPANY’S AGE:

9 YEARS

CHALLENGE

Seeking to modularize its offering through more standalone products and having doubled volume after the acquisition of larger players in the market, this e-commerce client needed support to effectively tackle these major transformations.

The first order of business involved redefining the organizational structure with a greater focus on different business models while considering regional expansion, segmented product offerings (vertical vs. bundled) and acquisitions. Second, the client needed to define the right approach to its PMIs, ensuring synergies would be captured and company capabilities would be maintained.

APPROACH

To address the organizational design aspect, we worked with the client to define drivers and organizational structures, along with detailing roles & responsibilities and future governance rituals. Interviews and workshops were held to delineate an organizational chart as well as a mapping of potential resources and gaps. Finally, a communication plan was developed for sharing the organizational structure and day-one strategy.

We worked together with the client to define and plan the PMI integration strategy, ensuring that their PMO was prepared to subsequently carry on the project. Pre-integration quick-wins were identified based on a calculation of synergy opportunities and phasing.

RESULT

Of the three synergy scenarios we identified, the most conservative represented over 1 million USD in synergy capture for the first year, representing over 9 percentage points compared to the EBITDA obtained the same year.

The client left with a clearly designed transition plan and end-game structure, along with definitions for each position. The governance pillars and rituals that were created provided a solid foundation for subsequent PMI activities, including day-one planning and preparation as well as an effective communication strategy.

INDUSTRY:

FOOD-TECH

COMPANY’S AGE:

1 YEAR

CHALLENGE

An innovative food-tech client from Asia in the area of plant-based meat was seeking to expand its operations to Europe – an unknown market context.

As competition in this part of the food sector and in the local market was growing fast, speed would be key for this start-up. Additionally, support in execution was essential as the very small client team needed to tackle everything, from strategic decision-making to operational execution, to develop the right pricing architecture, screen distributors and identify launch partners.

APPROACH

As a mixture of strategic guidance, PMO, task coordination and execution, the project required a very hands-on approach with constant touchpoints to ensure the client’s needs were being met at every step of the way. Cooperation was implementation-driven to generate immediate value for the client and avoid remaining theoretical for too long.

Three workfronts were addressed to drive different parts of the launch: securing foodservice outlets, organizing promotions and contracting a distributor. Setting the B2B pricing architecture required research and simulations to identify the competitor price landscape, prices across the food industry, distribution margins and final POS pricing. Manual research was needed to map distributors while web services were used to identify target foodservice outlets from a list of thousands in combination with quantitative analyses. Once defined, the team would immediately begin implementing and adjusting along the way.

RESULT

These joint efforts resulted in price definitions for the client’s plant-based meat products that exceeded the previous expectations of the management. Moreover, the product launch was achieved within a very ambitious timeframe: 10 weeks.

The novel product was launched at nearly a dozen foodservice outlets in the target city and the initiative sparked interest among numerous potential partners. Cooperation was established with two distribution partners to ensure the last mile of the localized supply chain. Finally, a roadmap along with operational and organizational requirements were defined and documented to allow the client to more easily scale the business outside in new regions.

INDUSTRY:

PROP-TECH

COMPANY’S AGE:

8 YEARS

CHALLENGE

An emerging prop-tech unicorn aimed to expand internationally and crack its very first foreign market, following the acquisition of a digital real estate company with a pre-established international presence.

The challenge involved defining an MVP for the new market in an extremely short timeframe, especially considering that they were relatively late to the game locally. Additionally, the client wanted to replicate the home business model as much as possible but had little idea about how the large target-market operated.

APPROACH

Applying a market-scan methodology would help the client gain an understanding of the market reality during this critical moment in their expansion. Due to the nature of the startup business, however, the teams agreed to work based on short-term sprints, with the aim of delivering progress quickly rather than relying on a drawn-out methodology timeline.

This setup allowed the teams to focus on interviews, desk research, strategy workshops and other approaches to gain market insights based on specific needs in any given week.

.

RESULT

With our support, the client was able to define a strategy and an MVP for the target market. Additionally, the lessons learned were replicated for expansion projects in other countries.

Specific deliverables included a detailed overview of the dynamics and workings of the local real estate market, a full picture of the competitive landscape and a survey with over 1,000 responses from consumers.