Hidden commercial disconnects in post-merger integrations

Publications

Hidden commercial disconnects in post-merger integrations

The deal is signed. The investment thesis is solid. The due diligence is complete.

Now comes the hard part: turning commercial synergy projections into reality.

Hidden commercial pitfalls

that undermine post-merger value

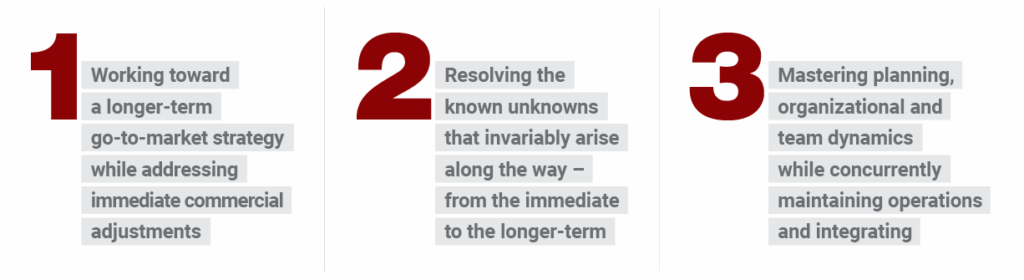

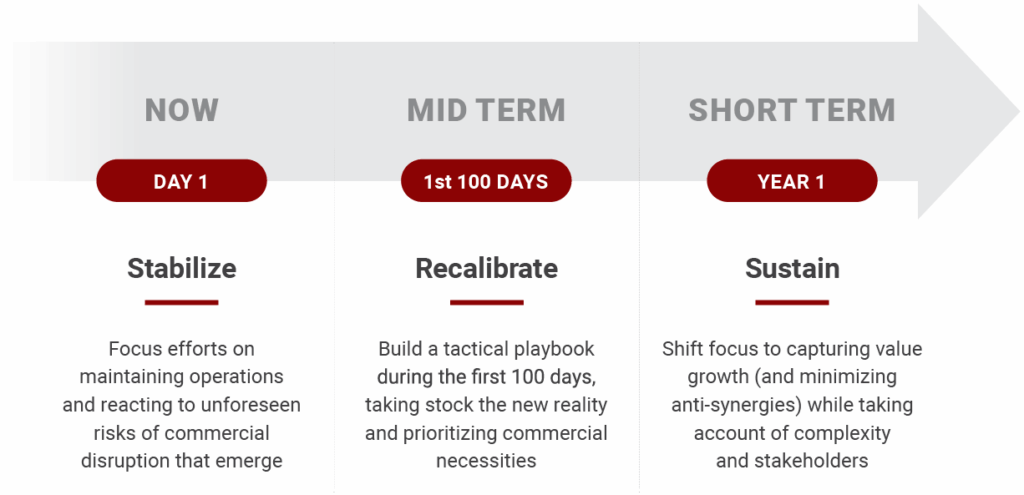

A critical point that we’ve seen many executives underestimate is how deeply different commercial models can clash – even when product portfolios appear similar on paper. As post-merger teams scramble to stabilize operations, the biggest barriers to value creation are often related to misaligned go-to-market (GTM) approaches, pricing structures and sales cultures.

Without early alignment on commercial models, even the strongest deals can unravel fast – from lost clients and delayed synergies to unexpected anti-synergies that erode volume and margin. In this article, we explore how commercial misalignment unfolds in real-world post-merger scenarios – and what C-level leaders can do to stay ahead of it. Our insights draw directly from two illustrative cases of real-life clients: one in the FMCG confectionary space, the other in the paper and pulp industry.

Lessons from the global M&A market

What makes commercial alignment

so tricky post-merger?

How can we prepare for the

unpreparable in integration planning?

Virtually any PMI will deal with turbulence, requiring timelines and hypotheses to be adjusted. In the euphoria of identifying positive elements in the investment thesis and signing the deal, even the most cautious leaders may underestimate the time and effort needed to iron out the details during the post-merger stage.

“We thought buying a business. As it turns out, we were algo buying a way of doing business that we hadn’t fully understood.”

– Executive of confectionary company

Discover how to turn commercial synergy projections

into reality in the full report

TALK TO US

- On 10 November 2025