Food System Transformation

With our global food system rapidly reaching a tipping point,

businesses are finding themselves at crossroads:

- The global population is projected to grow by 25% to 9.6 billion individuals by 2030: each of whom needs food.

- Concurrently, the arable land, species diversity and water supplies needed to sustain this growth are in decline.

These two mega-trends are moving in opposite directions, meaning 1.7 planet Earths will be needed to sustain our human footprint.

At the same time, consumers are increasingly showing us the way forward through their food preferences while investments and government regulations are expanding year over year.

For business, however, identifying a path to success is anything but clear as this field has emerged very rapidly. Three driving questions are challenging both new and established businesses in this regard:

- When is the right moment to react to these shifts?

- Is there a market for my product today or in the near term? Is there a pattern among consumers leading a particular direction toward healthier, more sustainable food consumption?

- What are the risks of not acting? Can we expect to face increasing penalties from governments and regulators or even be left behind by consumers in this rapidly developing market?

- Has the technology associated with this transformation matured to the point that we can scale the business and price competitively in our markets?

- What is the right size of reaction to establish, secure or grow our business?

- What is the suitable level of investment and focus to deliver optimum returns and establish a platform for future growth?

- How should we balance these new products with our current business while managing to take our customers on the same journey?

- Where will new opportunities present themselves with this shifted offering in terms of new markets, channels and business models?

- Where do we start or what should we do next to manage the transition to a new food system?

- How do we ensure our business has the clarity needed to set a solid direction, update our capabilities and clearly measure success?

- What materials are needed to grow and source new products and how do we guarantee the resilience of our supply chain?

- How do we successfully engage our customers and consumers with a renewed brand vision and product portfolio to distinguish the business from competitors?

Why Integration Consulting?

Integration has over 25 years of experience in guiding our clients through complex transformations where there are no tried-and-tested paths to success.

In recent years this has included:

- Supporting plant-based meat companies in bringing their products to new markets, including pricing, distribution and organizational capabilities

- Designing circular economy models for packaging companies to reduce waste

- Creating a disruptive roadmap for a cultured meat client to enter and win in selected markets globally

We also recognize that, beyond the technical skills we offer, empathy and the humility to understand the subtleties of your business’s specific situation are likewise key to ensuring success. A commitment to honesty and adherence to reality allows us to build a solid foundation for growth together.

We’ve executed countless projects together with diverse food and beverage clients across different geographies and links along the food system value chain:

Our Clients

How do we help?

Businesses need to conquer seven transitions to lead in this new Food System Transformation. Click on each for more info:

The closed-loop transformation

How do we create circular models in the value chain to reduce and re-use food and ancillary categories waste?

The unapologetic brand vision

How do we develop brands with mission, purpose and connection to the consumer?

FUTURE-PROOF SUPPLY CHAINS

How do we adapt supply chains to handle new materials, be resilient and cost-effective while reducing environmental impact?

Portfolio metamorphosis

How do we adapt our portfolio, changing its form, essence and substance towards healthy consumer lifestyle choices?

Sustainable & Resilient Sourcing

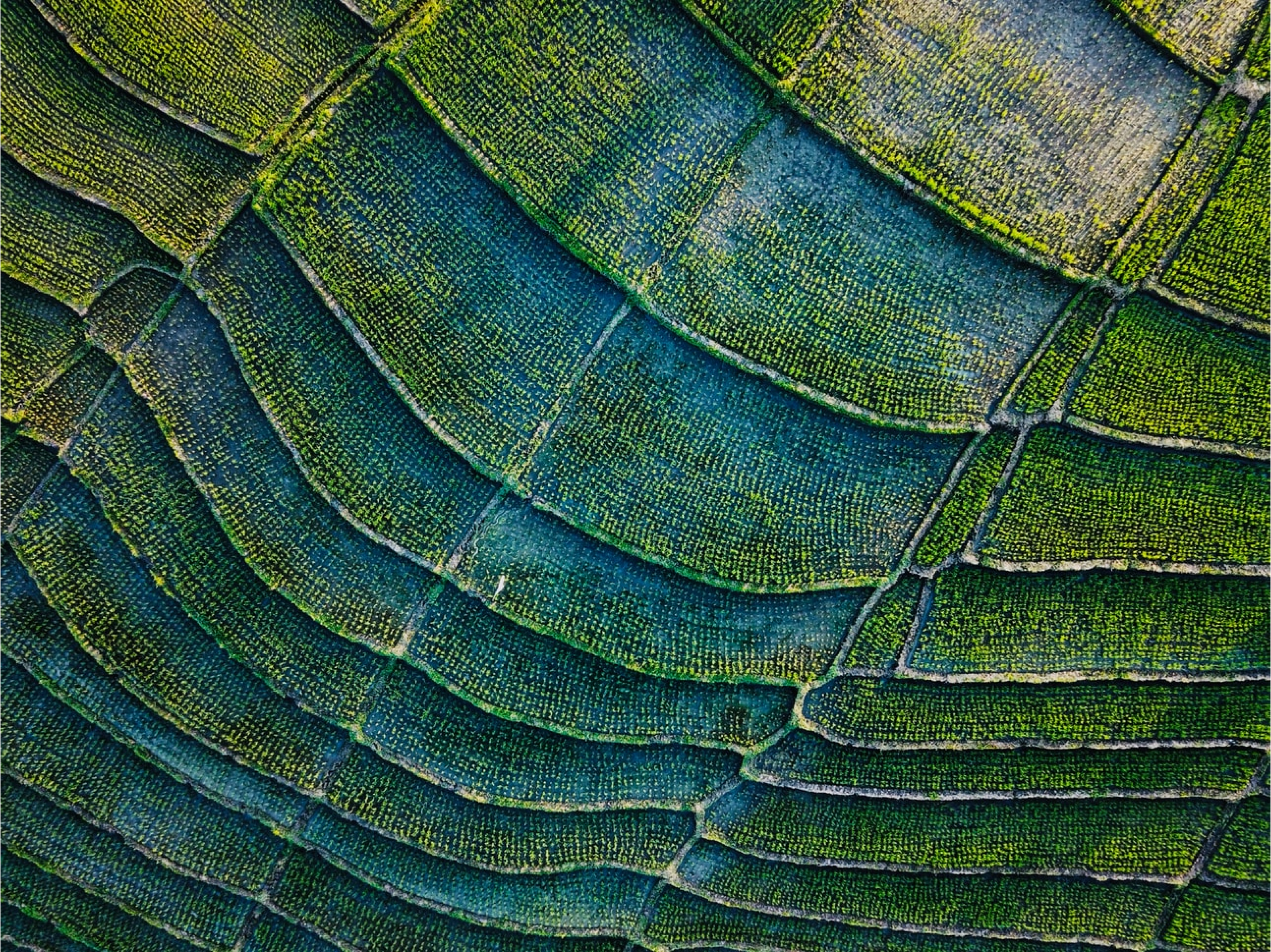

How do we grow and produce food to match consumption habits and overcome environmental challenges?

Protein GTM 5.0

How do we prepare our business to develop, supply and sell a new mix within a diversified protein supply landscape?

2030 E2E strategy

What are the trends in future food systems and how do we set strategies and an organizational model fit for the future?

The closed-loop transformation

THE DRIVING QUESTION

How do we create circular value chain models that reduce and re-use waste?

THE CHALLENGE

It has become imperative for the business world to take the environmental impact of the food system into account – and especially the high percentage of waste that remains a reality. To address this, the food system must become more resourceful and efficient in the way food along with side-streams products are used. For companies, this means creating closed loops for reusing and recycling resources to reduce or eliminate waste as well as new resources needed to maintain them.

HOW WE HELP

Integration supports clients in addressing key questions related to the closed-loop transformation:

Considering our entire value chain, what are the main sources of waste and potentially valuable side-stream products both now and in the future?

- How do we identify recipients for our side-stream products, either within our own business or in the broader ecosystem?

- How do we enable, incentivize and communicate with our ecosystem, especially customers and partners, to reduce waste and establish a circular economy?

- What types of technology, processes and capabilities that needs to establish a side-stream and circular supply chain?

- How do we establish and optimize a reverse logistics network?

- What is the financial impact and business case?

- What is the right sequence of activities that need to be implemented to make this a reality?

The unapologetic brand vision

THE DRIVING QUESTION

How do we develop brands with mission, purpose and connection to the consumer?

THE CHALLENGE

Regardless of the industry, brands need to convey a cohesive vision and purpose to their consumers. What may have proven successful in the past is not necessarily what will resonate with consumers in a transforming food system. As such, brands need to position themselves to represent the values and beliefs that the company wants to convey in a transparent and authentic way.

Pressure to act is building on the side of regulations and investments. Regulators are taking an increasing interest in interrogating company claims about products and benefits they offer while investors are scrutinizing companies actions and words for coherence and good performance – considering both financial and sustainability elements. In this emerging and diverse landscape, brands that are able to express a convincing mission and purpose as well as truly connect with their consumers can achieve a distinct advantage over the competition.

HOW WE HELP

- Integration supports clients in addressing key questions related to an unapologetic brand vision:

- How do we embed food system transformation into our strategy to ensure authenticity and “walking the talk”? How does that translate into our brand mission?

- How can we adjust to real-time transformations in an agile way without losing our brand essence?

- How do we position and utilize our brand's voice in a constantly changing world without compromising our identity?

- How can we learn from past mistakes to transform our brand and convey our vision?

- How can we guarantee that the voice of the customer is reflected when establishing our values and products?

- How do we create a halo effect around our brand to win over a broad number of consumers?

- How can we measure the success of our actions from a consumer standpoint?

- What is the financial impact and business case?

- What is the right sequence of activities that need to be implemented to make this a reality?

M&S – Brand management

IMP – Post-merger organization

FUTURE-PROOF SUPPLY CHAINS

THE DRIVING QUESTION

How do we adapt supply chains for new materials in a cost-effective manner?

THE CHALLENGE

In response to a fundamentally new strategy, GTM, portfolio and approach to sourcing, companies will need to radically adapt their supply chains. Taking the example of alternative proteins, supply chains can range from animal-based, agricultural, integrated supplies to more decentralized and industrialized chains.

This transition arguably represents the most fundamental physical change to the business that demand sizeable assets and investment. It also touches on all elements of the supply chain: strategy, organization, production capabilities, physical assets, skillsets, local/regional focuses, steering models, KPIs, raw materials, new materials, logistics, warehousing service levels and more. The biggest challenge is driving this change successfully and delivering a business case while maintaining business operations and profitability.

HOW WE HELP

Integration supports clients in addressing key questions related to future-proof supply chains:

- How will changes to products, technology, service levels, channel and raw materials impact our supply chain considering plan-make-deliver-return?

- Where should we produce and source from in the future and what will this mean for our manufacturing and logistics footprint?

- How do my planning process need to change?

- What do we insource and what do we outsource and where can partnerships be leveraged?

- What new skillsets and capabilities will be required to tackle these transformations?

- How do we adapt while maintaining business as usual?

- What is the financial impact and business case?

- What is the right sequence of activities that need to be implemented to make this a reality?

SCH – End-to-end supply chain strategy

SCH – Supply chain network design

IMP – Supply chain implementation

L&O – Change management

Portfolio metamorphosis

THE DRIVING QUESTION

How do we adapt our product portfolio to match healthy and sustainable lifestyles demanded by consumers?

THE CHALLENGE

Many incumbent companies are satisfied with the successful existing portfolio of products they have in place that has driven growth for years. However, with consumer demand shifting and regulations increasingly calling for actions to address environmental, societal and health considerations, companies need to rethink their product and service portfolio to match. The challenge lies in effectively transiting the business into this new landscape while tending to shorter-term financial commitments, shareholder interests and existing consumer demands.

HOW WE HELP

Integration supports clients in addressing key questions related to their portfolio metamorphosis:

- Who are our consumers? What do the consumers want and what’s driving their needs and motivations?

- What are the barriers preventing consumers from switching their consumption choices? Are there any cultural barriers in the way?

- What are the occasions that consumers experience? How do we effectively push a cultural shift among these consumers?

- What messages do we need to send in order to change mindsets around a certain product?

- What phasing is needed for our messaging and my product to go from niche to mainstream? What is our brand strategy?

- How can we make our products and brand appeal to the masses? How does translate into products and portfolio?

- What is the financial impact and business case?

- What is the right sequence of activities that needs to be implemented to make this a reality?

M&S – Portfolio management

IMP – Post-merger organization

L&O – Change management

Sustainable & resilient sourcing

THE DRIVING QUESTION

How do we grow and produce food to overcome environmental challenges and lower supply chain risk?

THE CHALLENGE

The food systems transformation will impact sourcing in two major ways:

- The need to acquire different raw materials with different dynamics and requirements, e.g. natural plant-based raw materials with an impact on sourcing, region, handling, seasonality, pricing dynamics, business intelligence needs, the organization and more

- An imperative to make sourcing more sustainable and resilient, going beyond certifications of raw materials (e.g. eco-labels) and requiring companies to drive their upstream supply chain more by partnering with suppliers, entering strategic alliances, influencing ways of working among suppliers etc. The overall aim and challenge lies in growing food more sustainably, adapting to changing habits such as for raw materials wanted and tackling environmental risks such as water availability.

- Where do our weak points lie in terms of sourcing now and in the future? Where is our exposure highest? How is the global transformation of the food system impacting our sourcing categories?

- How can we increase resilience across the value chain to ensure reliable supplies while maintaining cost advantages and agility?

- What are the right measures to ensure sustainability in sourcing, especially in new sourcing categories that often involve natural materials with specific challenges and dynamics?

- What skillsets and capabilities will be needed to address these transformations?

- What is the financial impact and business case?

- What is the right sequence of activities that need to be implemented to make this a reality?

HOW WE HELP

Integration supports clients in addressing key questions related to sustainable and resilient sourcing:

ALT. PROTEIN GTM 5.0

THE DRIVING QUESTION

How do we develop, supply and sell a new mix in a diversified protein supply landscape?

THE CHALLENGE

Having undergone rapid development in recent years, the protein supply landscape has become very diverse and moved beyond a momentary interest. At the same time, routes to market have also transformed over the last decade, and consumers are becoming increasingly adept at traversing many channels.

The challenge for incumbent and disruptive businesses alike is to set up a very clear and novel go-to-market strategy (GTM) and implementation plan in response to customer target segments, channels, pricing and all the other related elements. This must effectively incorporate the development, supply and sale of their chosen mix of proteins, using the appropriate blend of traditional and modern channels available to ensure successful execution.

HOW WE HELP

Integration supports clients in addressing key questions related to the alternative protein go-to-market:

- What are the roles of each channel in this transition considering brand, volume, visibility and value?

- How can we utilize our traditional channels to show our brand is normal?

- How can we leverage new channels such as direct-to-customer to launch and to boost our volume?

- How can we use specialized channels to deliver better service?

- How do we handle messaging and negotiation for something new with our key accounts?

- How can we guarantee our full product mix is at the right customers?

- How can we anticipate future regulations and legislation to plan our portfolio and channel options?

- What is the financial impact and business case?

- What sequence of activities needs to be followed to turn the transformation into a reality?

M&S - Market Entry

M&S - Go To Market

IMP - GTM Implementation

L&O - Org Design

L&O - Change Management

2030 E2E strategy

THE DRIVING QUESTION

How do we create a future-proof strategy and organizational model in line with emerging trends?

THE CHALLENGE

Being successful in a changing food system requires a redefinition of business strategies. With the industry and the world changing, companies need to prepare and make a fundamental shift to not be left behind. This includes all the different elements for turning strategy into a reality – from the organizational model to the supply chain and go-to-market strategy.

While our experience shows that companies know they need to start doing something, many are overwhelmed and lack clarity about where to start. This often leads to a patchwork of initiatives that are inconclusive and fail to provide an end-to-end strategy for making effective decisions and acting in a fast-moving marketplace. Above all, companies need to be able to establish the right direction, pace and quality of execution as well as authenticity in their brand and portfolio management.

HOW WE HELP

Integration supports clients in addressing key questions related to their 2030 end-to-end strategy:

- Where is our place in a transformed food system? Do we want to be a leader or a follower?

- How do we embed food system transformation into our strategy to guarantee authenticity and “walking the talk”?

- What core capabilities are needed to pursue this food system transformation? How ready are we people to lead this change and become ambassadors of the transformation?

- What kind of organization is needed to drive a transformational strategy? Do we need a separate business unit to address new developments or involve the entire organization?

- Are we aware of our unique selling point and able to transmit this effectively compared to the competition?

- Do we have the right KPIs to measure “food system transformation” in an end-to-end manner?

- What is the financial impact and business case for this transformation?

- What sequence of activities needs to be followed to turn the transformation into a reality?

F&M – Strategic roadmap

IMP – Post-merger integration

L&O – Cultural Shape

L&O – Organizational design

Business has a key role to play, and acting now will provide financial rewards.

Consumers, investors and regulatory bodies are the three broad factors driving this transformation:

SUCCESS STORIES

CHALLENGE

An innovative food-tech startup was seeking to conquer the emerging market of cultured meat – one that was already filled with competitors racing to develop viable products.

The challenge involved tackling a nascent market characterized by high levels of uncertainty, working on assumptions in the absence of concrete data while needing to develop and update models as new information emerged. Considering the difficulties of driving a business still largely in the R&D stage paired with uncertainty on the consumer side in terms of acceptance, sizing the actual market potential was a serious obstacle.

Apart from R&D advancements, the client needed to develop a mid-term business plan to manufacture and bring its products to market. To do so, they required support to:

- Identify priority markets and outlets

- Set models for key business area objectives (such as R&D, manufacturing and sales) focused on enabling scalability at pace and

- outline a clear narrative to governments, regulators and other market players in order to accelerate approval processes.

APPROACH

Integration supported this client in carrying out a global market scale and value-chain assessment of the cultured meat industry. This involved determining the expected market size for their product in major markets as well as value-chain maps and the regulatory and taxation landscape. As new technology would be needed, it was important to answer questions such as:

- which industries to potentially partner with

- who had access to related technology

- whether to process the product in-house or provide basic material to other players on that part of the value chain

To simulate revenue and costs per market over the subsequent five years, financial modeling was carried out to guide strategic choices, business planning, regulatory initiatives and product timelines. Finally, the teams worked together to develop a detailed business roadmap outlining required activities and timelines per business pillar.

RESULT

At the end of the project, the detailed market scan offered the client a clear picture of the challenge at hand, supported by information on profit-pool sizing per target market, which would serve as a basis for pitches to investors.

A simulation tool was likewise developed conjointly to facilitate up-to-date strategic decisions as new market information emerged along with a framework for the client to carry out future analyses on their own. Finally, a roadmap up to 2025 with target milestones for each key business area put the business on a clear path forward.

CHALLENGE

A pioneer of plant-based meat in its home market had its eyes set on breaking into the high-growth, highly competitive European food retail environment. The company had already formed a partnership with a local distributor, but needed help:

- Prioritizing the markets for entry

- Understanding the competitive landscape and specific local realities in the markets

- Establishing a local operation to start selling in Europe

Given the rapid expansion of the market, speed to launch was particularly important to the involved stakeholders.

APPROACH

To achieve these objectives, the project started out by prioritizing markets for entry. Together with the client team, we carried out a market scan of 25 European countries considering the degree of ease and attractiveness for entry followed by a deep dive into five prioritized markets – considering success factors, profitability, category maturity, positioning etc.

An entry strategy was defined with clear phasing for the roll-outs, speed of entry in the different channels and volume distribution projection. We conducted an analysis of landed cost and price positioning in store to ensure attractive margins along the chain and competitive price to the consumer. An entry plan was also developed jointly with the distributor.

RESULT

The project led to the definition of a practical and replicable three-year growth plan. The client was able to successfully launch across eight European markets and entered into an exclusive agreement at a big-four supermarket retail chain in the UK. Finally, the project provided support in pursuing additional fundraising rounds, placing the plant-based meat startup at a valuation of over 100 million USD.

CHALLENGE

After becoming a leader in plant-based meat products in its home market, a food-tech startup sought to expand its presence internationally in the retail and foodservice business. The first major challenge was external: increasing revenue over 20-fold, mainly through geographic expansion into foreign markets. This meant the client needed to understand how trends were evolving to decide which market to enter. As this was an alternative food product, many different regulations existed across markets, e.g. approval, packaging, labels, naming etc.

The second major challenge was internal: fast-paced growth meant more processes and complexity, calling for improved internal organization and structure. Cultural pain points were appearing that would have to be addressed, e.g. inconsistent communication, unclear career paths and insufficient staff recognition for achievements.

APPROACH

The project aimed to create a strategic plan and define the internal organization with an updated organizational model. This would entail creating a holistic strategic roadmap using working sessions to address major objectives, KPIs and milestones related to manufacturing, marketing, systems, infrastructure, go-to-market and innovation.

As they gained scale and expanded, an assessment was needed to decide whether to stay with the third-party manufacturers or build their own plant – considering volume forecasts, cost (breakeven point), logistics and location. Markets would also have to be prioritized for entry based on the regulatory complexity. Finally, with a relatively high price point (up to 5x that of conventional meat in some markets), the sales approach had to be adjusted and we had to consider how to present and adapt the product portfolio in a way that would be attractive to customer tastes.

RESULT

These efforts led to the development of a five-year roadmap of activities and projects to achieve the mid-term ambitions. A market overview was created with the current and projected market sizes for plant-based products along with a segmentation tool to prioritize markets. After identifying Asia as the next priority region, the project provided guidance on adapting the product portfolio to optimize attractiveness in an entirely different context.

To sustain growth and maintain cost competitiveness, the decision was made to establish a global manufacturing and support hub to serve all commercial markets. The client also improved distribution by establishing a dedicated in-house sales force and optimizing logistics routes by moving to more efficient and environmentally friendly packaging.

To optimize sales in Europe, the company successfully adjusted its product and packaging to address local customer lifestyle and dietary choices when manufacturing and presenting its products – highlighting environmental and organic commitments on the packaging.

CHALLENGE

An innovative food-tech client from Asia in the area of plant-based meat was seeking to expand its operations to Europe – an unknown market context. As this was a new continent for the client, with a highly diverse and heterogeneous market, the challenge would entail recalibrating the entire business to serve this entirely new context as quickly as possible.

As competition in this part of the food sector and in the local market was growing fast, speed would be key for this start-up. Additionally, support in execution was essential as the very small client team needed to tackle everything, from strategic decision-making to operational execution, to develop the right pricing architecture, screen distributors and identify launch partners.

APPROACH

As a mixture of strategic guidance, PMO, task coordination and execution, the project required a very hands-on approach with constant touchpoints to ensure the client’s needs were being met at every step of the way. Cooperation was implementation-driven to generate immediate value for the client and avoid remaining theoretical for too long.

Three workfronts were addressed to drive different parts of the launch: securing foodservice outlets, organizing promotions and contracting a distributor. Setting the B2B pricing architecture required research and simulations to identify the competitor price landscape, prices across the food industry, distribution margins and final POS pricing. Manual research was needed to map distributors while web services were used to identify target foodservice outlets from a list of thousands in combination with quantitative analyses. Once defined, the team would immediately begin implementing and adjusting along the way.

RESULT

These joint efforts resulted in price definitions for the client’s plant-based meat products that exceeded the previous expectations of the management. Moreover, the product launch was achieved within a very ambitious timeframe: 10 weeks. The project essentially started from zero and succeeded in setting a distributor and launch activities such as PR, marketing, communications, promotions and partners, in a wide variety of establishments – from casual to haut cuisine.

The novel product was launched at nearly a dozen foodservice outlets in the target city and the initiative sparked interest among numerous potential partners. Cooperation was established with two distribution partners to ensure the last mile of the localized supply chain. The project leveraged the small-scale facility with just a few reactors, promoting a more local and future-proof supply chain that was smaller, leaner and free of the usual negative impacts on the surrounding community caused by animal farming.

Finally, a roadmap along with operational and organizational requirements were defined and documented to allow the start-up to more easily scale the business outside in new regions.

Talk to us

- On 6 July 2022