Manufacturing capacity landscape and scaling strategies for fermentation derived protein

Fermentation – Derived Protein

Manufacturing capacity landscape and scaling strategies

Fermentation-derived products are a rapidly growing category within the alternative protein space. Driven by innovations in biotechnology – enabling microbes such as yeast and bacteria to produce proteins, fats, oils and other ingredients – many foods can now be made using animal-free methods. These advancements have set the stage for fermentation-derived products to earn a widespread presence in food formulations and on store shelves.

The biomass fermentation industry, in particular, has seen a rapid diversification in microbial species, production methods and consumer products. To ensure long-term category growth, the industry must identify and address limitations in manufacturing capacity and technical capabilities to accommodate rising demand and ever-improving innovations in microbial biotechnology and fermentation approaches.

In partnership, The Good Food Institute and Integration developed this report that supports industry decision-making. It captures the global manufacturing capacity landscape of fermentation-derived products, exploring the trade-offs of strategies to scale manufacturing capacity – from partnering with contract manufacturing organizations to constructing greenfield or brownfield sites and retrofitting used equipment.

The report combines data analysis, industry-wide insights and viewpoints from a diverse range of players across the fermentation-derived product value chain to provide an overview of challenges facing these product manufacturers along with valuable considerations for how to address them.

CAPACITY LANDSCAPE

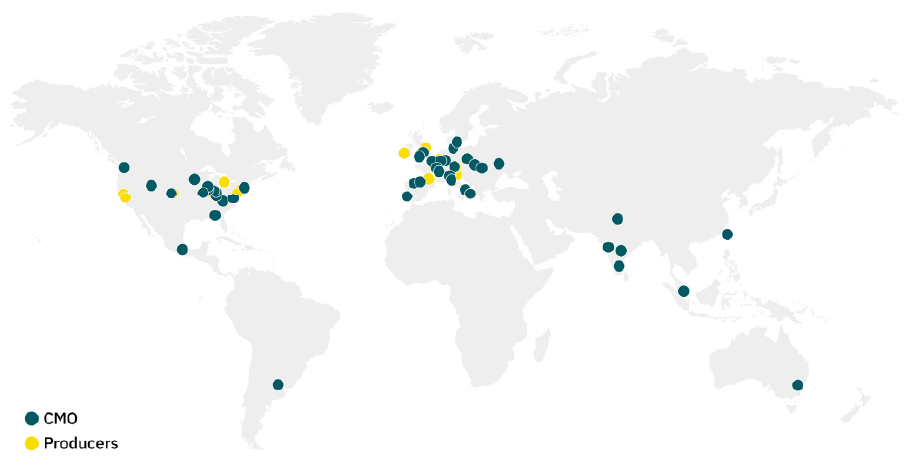

There is a notable lack of capacity outside of Europe and North America, particularly on a commercial scale.

The combined capacity of CMOs and in-house producers is predominately concentrated in Europe, accounting for 47 percent of total capacity, and North America, with 34 percent. Minimal capacity is registered outside of these regions, with Mexico, Singapore, and South Korea are the markets with the largest capacity outside of North America and Europe.

Even in markets at a higher level of biotechnological advancement (such as the U.S.), there is an opportunity to expand fermentation-derived product manufacturing capabilities.

There is greater demand in North America, APAC, Africa and the Middle East compared to Europe or Latin America. This relationship suggests that producers in the United States seeking to outsource production may be more inclined to choose Europe or Latin America due to available capacity.

Despite the U.S. containing a significant percentage of the global fermentation-derived product capacity (34%), there remains the opportunity to develop regional capacity for food-grade fermentation.

Solutions for the road ahead:

The fermentation industry urgently needs to increase capacity at pilot and demo scale in the short term. This means procuring and developing opportunities now to enable achieving commercial-scale operations for the industry’s long-term capacity needs.

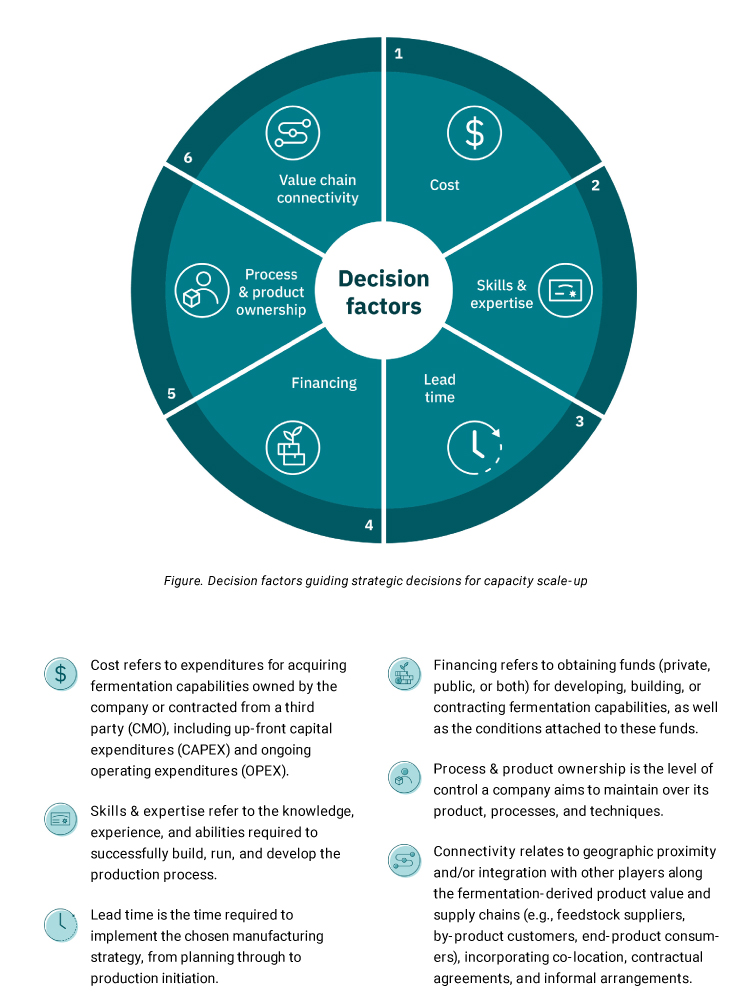

A variety of strategies exist for companies seeking to scale up production along each step of the technology development process (R&D to pilot, pilot to demo, and demo to commercial). Our analysis focuses on two critical strategic decisions from the perspective of the producer at each step in the scale-up process:

- either partnering with a contract manufacturing organization or building a proprietary facility

- either building a greenfield facility or pursuing brownfield development of an existing facility when seeking the proprietary option

These decisions can be evaluated using six decision factors, which are broadly applicable to industry players but may be weighed differently depending on a company’s specific context.

For more insights into the manufacturing capacity landscape of fermentation-derived proteins, along with key considerations for businesses seeking to carve out a future in this space, download the full report.

Talk to us

- On 25 July 2023