What challenge(s) do our clients face?

The future of agribusiness impacts us all, from businesses and investors to people and the planet. In this hugely diverse sector marked by cycles and high levels of unpredictability, companies across the agribusiness value chain have always had to deal and adjust.

Variables such as international trade volatility, disruptive biological solutions, sustainability imperatives and technological advances have now made it more critical than ever for these businesses to incorporate strategy, sound planning and efficiency into their operations.

Movement and storage of agricultural inputs and products

- Overloaded logistics networks with low level of predictability

- Increasing costs for storing products and materials, incurring losses

- Growing need for “on demand” deliveries, with resellers responsible for stocking/warehousing

New solutions and biological products

- Development of cutting-edge biological inputs

- Strengthening of generic products

- Acquisitions among industries

- Rapid adoption and development of biological technologies

Protect profitability in a volatile market context that is:

- Dependent on imported fertilizers

- Exposed to international markets, long supply chains and scarce inputs

- In need of more sophisticated financing options

Producers demanding technology, digital and financial services

- Contracting precision agricultural services

- Data being used as a basis for purchasing decisions and data-driven solutions

- Financing being offered via digital channels

- Increasing demand for input and harvest insurance

Increased competition within the value chain

- Investment funds more present

- Workplace pressured by increasing competition

- Adjusting management maturity inside the gate

- Risk management low and failing to support growth

- Changing generations, with younger leadership

Sustainability taking center stage

- Climate change directly impacting planning and harvests

- Constant need to boost productivity

- Ensuring risk management in a turbulent environment

- Traceability & segmentation becoming more in demand

- ESG pressure and increasing controls, especially from EU

Difficulty ensuring flow and storage of supplies and agricultural products

- Logistics networks overloaded, with little predictability

- Increasing cost of storage for production and inputs, with potential losses incurred

- Rising demand from producers for on-demand stock/ storage offered by resellers

How do we help?

Integration’s agribusiness solutions deliver the change businesses & people need in the face of global & industry challenges.

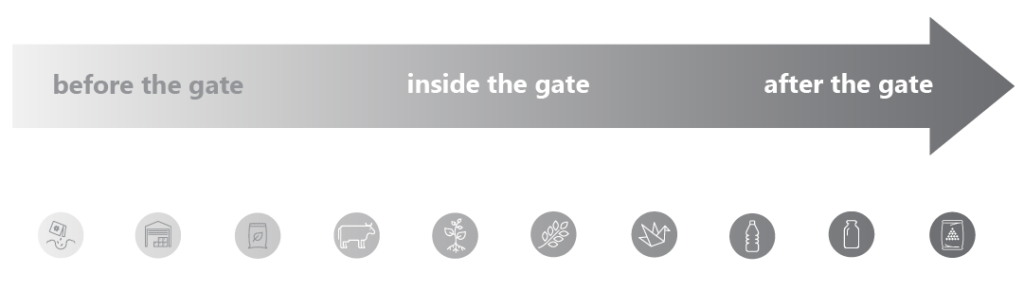

We believe the best solutions combine your deep knowledge of the business and market with our cross-industry best practices and technical methodologies. Our differentiated approach to supporting agribusiness clients before, inside & outside the gate is based on three pillars:

Pillar I

EXPERIENCE & EXPERTISE ACROSS THE AGRIBUSINESS VALUE CHAIN

Professionals dedicated to agribusiness projects, boasting strong track-record across diverse segments within the sector

300+ projects delivered

Solutions delivered across entire agribusiness value chain

In-house team in Europe working on the future of the food system

A global consultancy with agribusiness roots in Brazil

Pillar II

END-TO-END SOLUTIONS, CROSS-DISCIPLINARY AND CROSS-INDUSTRY

Projects across diverse sectors, for cross-industry references

Global project experience across 85+ countries with diverse contexts and challenges

Provoking innovation and driving change in agribusiness

Multi-disciplinary and holistic solutions with actionable and recommendations

Pillar III

FOCUS ON REALITY IN THE FIELD & IMPLEMENTATION

Fully integrated teams from day 1, to achieving objectives together hands on

Projects that deep-dive into client’s reality and business

Teams that translate context-specific challenges into solutions

Attention to cultural and organizational differences

Always respecting the legacy and knowledge of our clients

Commonly applied services

Clients

Integration has a solid track record of 300+ projects addressing diverse business needs before, inside and after the gate.

SUCCESS STORIES

CHALLENGE

Strategic roadmap for an international conglomerate with rapeseed oil mill in Germany producing biodiesel and other derivatives for the spot market.

Client needed support in preparing the facility’s management to diversify the business by adopting strategic planning that would allow for a more downstream approach.

They faced a lack of experience with longer-term planning and production cycles, demanded extra mile for capacity building.

APPROACH

Provided a better understanding of the plant’s as-is and to-be organizational structure, processes and expertise that would facilitate a transformation considering limitations.

Co-created a multi-year strategy and developed a governance model to sustain the strategic approach through extensive, detailed training sessions and support tools.

Ensured that the PMO and the governance got off the ground and capable of incorporating strategic vision along with daily operations.

RESULT

Client gained a clear path for moving the business downstream – getting closer to final customers and reducing dependency on the spot market through a more differentiated portfolio, including a strategic roadmap involving 10 different areas and 100% of the portfolio.

Inspired a much-needed shift in mindset among 15 key professionals beyond a strictly day-to-day view, with client now able to consider and address relevant macro-trends in planning.

CHALLENGE

Detailed strategic roadmap for a global player in area of agricultural inputs seeking to enter highly diverse and complex Brazilian agribusiness market.

Comprehensive market entry plan with granular analysis delivered, allowing clear assessment of no/no-go scenarios.

Highly complex and diverse market, differentiated by region and client type, required understanding the complexities, dynamics and necessities of each specific region, as well as local mentalities and key decision-making factors.

APPROACH

Partner on the ground to deliver comprehensive and market scan, differentiated by diverse regions and customer types.

Mapped complexities of local market across geographies and sub-markets.

Identified dynamics, needs and challenges of each specific region, interviewing farmers, distribution partners and other companies.

Delivered an end-to-end vision, including critical logistics factors and tax implications.

RESULT

Client gained clear picture of the best possible ways to enter the Brazilian market, arriving at two scenarios based on an initial mapping of 8 potential investment alternatives.

Critical qualitative elements of market dynamics, mindset and decision-making factors also included so client could grasp the mentality of target consumers, beyond the numbers.

CHALLENGE

Go-to-market strategy for a multinational industrial and agricultural input provider seeking to grow aligned with their long-term objectives and 5-year plan.

Design a continental yet individualized strategy to encompass countries in the LATAM operation, with different characteristics in crop systems, market size and positioning, strategic attractiveness etc.

Manage impacts project would have among countries – some positive and others negative, overcoming different levels of anxiety and change-management challenges.

APPROACH

Gained a detailed understanding of company’s current commercial model and the market perspective, identifying internal and external opportunities.

Segmented existing clients/countries by behavior and attractiveness, including market sizing, performance and strategic objectives by cluster.

Prioritized investments, with a consolidated LATAM view, based on initiatives from every country to maximize ROI.

Full review of “guard-rails” for implementation, with best strategy for each sub-region.

RESULT

Recommendations increased sales by 13-20% for LATAM operation, with similar increase in EBITDA and a slight decrease in percentual profitability.

Prioritization of profitability in non-strategic countries and fostering growth in key countries in the region, with potential revenue through the segmentation estimated at 10 million USD.

The LATAM team capacitated and gained ownership for each step of the methodology, which was even replicated in other internal projects of the company..

CHALLENGE

Due diligence for a private equity firm seek to expand in agribusiness via the acquisition of two retailers focused on agricultural input and animal feed.

The client sought to address a national market totaling 3 billion USD.

A high number of key stakeholders (15 partners) had to be carefully addressed along with the fact that the companies were technologically behind.

APPROACH

Conduced due diligence focused on market potential, a review of distribution channels and potential for geographic expansion.

Mapped operational synergies and value levers, considering an estimated reduction of 6-10 million USD in stock spending.

Structured an integration plan for the two companies for the first 100 days, with details on critical activities and a communication plan for internal and external audiences.

RESULT

Maximized the financial return and perceived value for the client through the centralization and structuring of an integrated purchasing a

Client gained a detailed store expansion plan focused on existing operational regions.

Clear plan for the future based on identification of needs for new animal feed production plants to optimize the positioning of existing stores and plants.